Deal of The Day! Hurry Up, Grab the Special Discount - Save 25% - Ends In 00:00:00 Coupon code: SAVE25

PRMIA Exam 8006 Topic 5 Question 14 Discussion

Actual exam question for

PRMIA's

8006 exam

Question #: 14

Topic #: 5

[All 8006 Questions]

Topic #: 5

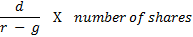

According to the dividend discount model, if d be the dividend per share in perpetuity of a company and g its expected growth rate, what would the share price of the company be. 'r' is the discount rate.

A.

B.

C.

D.

Suggested Answer:

A

According to the dividend discount model, the spot share prices represent the present value of all the future cash flows from the stock. If held till perpetuity, this becomes an annuity equal to the dividend, growing at its expected growth rate. Therefore Choice 'a' is the correct answer. Choice 'c' would represent the total market cap, and not the value per share that the question asks.

Currently there are no comments in this discussion, be the first to comment!