PRMIA Exam 8006 Topic 10 Question 2 Discussion

Topic #: 10

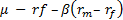

Which of the following expressions represents Jensen's alpha, where is the expected return, is the standard deviation of returns, rm is the return of the market portfolio and rf is the risk free rate:

A.

B)

C)

D)

The Sharpe ratio is the ratio of the excess returns of a portfolio to its volatility. It provides an intuitive measure of a portfolio's excess return over the risk free rate. The Sharpe ratio is calculated as [(Portfolio return - Risk free return)/Portfolio standard deviation].

The Treynor ratio is similar to the Sharpe ratio, but instead of using volatility in the denominator, it uses the portfolio's beta. Therefore the Treynor Ratio is calculated as [(Portfolio return - Risk free return)/Portfolio's beta]. Therefore Choice 'a' is the correct answer.

Jensen's alpha is another risk adjusted performance measure. It considers only the 'alpha', or the return attributable to a portfolio manager's skill. It is the difference between the return of the portfolio, and what the portfolio should theoretically have earned. Any portfolio can be expected to earn the risk free rate (rf), plus the market risk premium (which is given by [Beta x (Market portfolio's return - Risk free rate)]. Jensen's alpha is therefore the actual return earned less the risk free rate and the beta return. Choice 'c' is the correct answer.

Refer to the tutorial on risk adjusted performance measures for more details.

Currently there are no comments in this discussion, be the first to comment!