Pegasystems PEGAPCDC85V1 Exam Questions

- Topic 1: Create eligibility rules using customer risk segments/ Define and manage customer actions

- Topic 2: Create engagement strategies using customer credit score/ Optimize the customer value in the contact center

- Topic 3: Create and understand decision strategies/ Present a single offer on the web

- Topic 4: Share action details with third-party distributors/ Add more tracking time periods for contact policies

- Topic 5: Prioritize actions with business levers/ Contact policy and volume constraints

- Topic 6: Avoid overexposure of actions on outbound/ Essentials of always-on outbound

- Topic 7: Define customer engagement policies/ Define the starting population/ Define an action for outbound

- Topic 8: Limit action volume on outbound/ Create an engagement strategy/ One-to-one customer engagement

- Topic 9: Action prioritization with AI/ Avoid overexposure of actions/ Create a real-time container

Free Pegasystems PEGAPCDC85V1 Exam Actual Questions

Note: Premium Questions for PEGAPCDC85V1 were last updated On 08-12-2021 (see below)

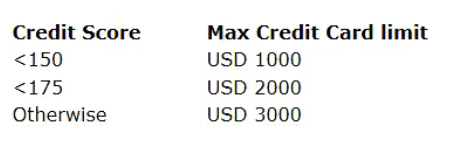

U+ Bank uses a Next-Best-Action decision strategy to automatically approve credit card limit changes requested by customers. A scorecard model determines the customer credit score. The automatic approval of credit card limits are processed based on the following criteria set by the bank:

The bank wants to change the threshold value for the USD 2000 credit limit from ''<175'' to ''<200''.

As a Strategy Designer, how do you implement this change?

U+ Bank, a retail bank, wants to send promotional emails related to credit card offers to their qualified customers. The business intends to use the same action flow template with the desired flow pattern for all the credit card actions.

What do you configure to implement this requirement?

U+ Bank's marketing department currently promotes various home loan offers to qualified customers. Now, the bank does not want to show offers on a customer's account page if the customer has already received three home loan offers in the last two weeks.

What do you need to define to implement the business requirement?

To which types of decisions can Pega Customer Decision Hub be applied?

MyCo, a telecom company, wants to present their customers on Facebook with customer-centric mobile internet offers. What action must MyCo take to meet this business requirement?

- Select Question Types you want

- Set your Desired Pass Percentage

- Allocate Time (Hours : Minutes)

- Create Multiple Practice tests with Limited Questions

- Customer Support

Currently there are no comments in this discussion, be the first to comment!