New Year Sale 2026! Hurry Up, Grab the Special Discount - Save 25% - Ends In 00:00:00 Coupon code: SAVE25

CIMAPRO19-P01-1 Exam - Topic 4 Question 25 Discussion

Actual exam question for

CIMA's

CIMAPRO19-P01-1 exam

Question #: 25

Topic #: 4

[All CIMAPRO19-P01-1 Questions]

Topic #: 4

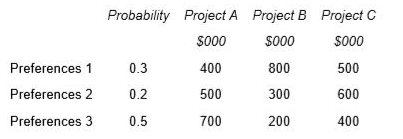

A company has to choose between three mutually exclusive projects. Market research has shown that customers could react to the projects in three different ways depending on their preferences. There is a 30% chance that customers will exhibit preferences 1, a 20% chance they will exhibit preferences 2 and a 50% chance they will exhibit preferences 3. The company uses expected value to make this type of decision.

The net present value of each of the possible outcomes is as follows:

A market research company believes it can provide perfect information about the preferences of customers in this market.

What is the maximum amount that should be paid for the information from the market research company?

Suggested Answer:

B

References:

Madonna

4 months agoAlbert

4 months agoMarshall

4 months agoRachael

4 months agoKati

5 months agoNarcisa

5 months agoMargart

5 months ago