Deal of The Day! Hurry Up, Grab the Special Discount - Save 25% - Ends In 00:00:00 Coupon code: SAVE25

CIMA Exam CIMAPRA19-F01-1 Topic 6 Question 37 Discussion

Actual exam question for

CIMA's

CIMAPRA19-F01-1 exam

Question #: 37

Topic #: 6

[All CIMAPRA19-F01-1 Questions]

Topic #: 6

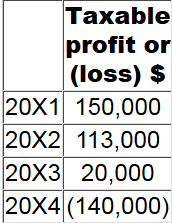

In 20X4, DEF closed its business having made a trading loss of $160,000. In DEF's country of residence, trading losses may be carried back three years on a LIFO basis.

The profits for the last four years of trading were:

What are the taxable profits or losses for years 20X1 and 20X2?

Suggested Answer:

B

Currently there are no comments in this discussion, be the first to comment!