CFA Institute Exam CFA-Level-II Topic 3 Question 68 Discussion

Topic #: 3

Ryan Hendricks serves as a security analyst for Investment Management, Inc. (IMI), which employs the Treynor-Black model to evaluate securities and to make portfolio recommendations. IMI uses the capital asset pricing model (CAPM) to determine the degree to which securities may be mispriced relative to IMFs forecasts.

Hendricks evaluates the common shares of Computer Software Associates (CSA), a small company specializing in a unique computer software market niche. Hendricks obtains the following market model results for CSA, using monthly returns for the past 60 months:

Hendricks uses the adjusted beta method to derive his forecasts for companies' future betas. In deriving his forecast for any company beta, Hendricks uses the following first-order autoregressive formula:

forecast beta = 0.33 + 0.67 x (historical beta) (2)

Hendricks derives required returns for individual securities using the CAPM after making appropriate adjustments using his adjusted beta formula in equation (2).

IMI provides Hendricks with the following capital market forecasts to use as inputs for the CAPM.

IMI asks Hendricks to make decisions to take long and short positions in individual securities for IMl's actively managed portfolio, IMI-Active. Specifically, Hendricks is asked to examine CSA and Millennium Drilling (MD), an oil and gas drilling company specializing in deep sea drilling. After a thorough examination of the prospects for each company, Hendricks derives the following alpha forecasts for CSA and MD.

Hendricks forecasts that the unsystematic variance (the variance of the market model regression error) for MD will be more than double that of CSA .

After determining the appropriate allocations across securities within the IMI-Active portfolio, Hendricks derives the portfolio predictions shown in Exhibit 3.

IMI forecasts that the total standard deviation for the S&P500 returns will equal 20%. After examining the historical forecasting abilities of Hendricks, IMI determines that Hendricks has demonstrated perfect forecasting ability in regards to CSA stock, but imperfect forecasting abilities in regards to MD stock. IMI finds that the correlation between the realized alphas for MD and the forecast MD alphas provided by Hendricks equals 0.50.

Referring to the Treynor-Black model, Hendricks makes the following statements:

Statement 1: All else equal, the Treynor-Black model increases the weight to the active portfolio as its unsystematic risk increases.

Statement 2: The Treynor-Black model is based on the premise that only a limited number of stocks should be included in the actively managed portfolio.

Hendricks' forecasts for the CSA beta and future return are closest to:

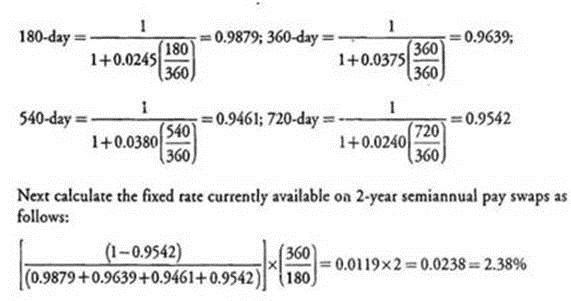

At the initiation of GlobeCorp's fixed rate payer swap, the value was zero and the fixed rate was set at 2.75%. To determine the change in the value of the swap, we must determine the fixed rate on comparable swaps available today using the LIBOR curve. Since a year has passed since the initiation of the swap, a comparable swap as of today would be a 2-year swap with semiannual payments. First calculate the discount factors for the 180-, 360-, 540-, and 720-day LIBOR interest rates as follows:

GlobcCorp could enter into an equivalent swap today at an annualized fixed rate of 2.38% versus the fixed rate of 2.75% that it is currently paying on the existing swap. Therefore, the existing swap has negative value to GlobeCorp and has thus decreased from an initial value of zero. Current credit risk is greater for NVS Bank since the negative value of the swap to GlobcCorp increases the chance that the company will default on the obligation and fail to make the required payments to NVS. (Study Session 17, LOS 6l.c,i)

Amie

3 days agoTy

4 days agoMitsue

6 days ago