CFA Institute Exam CFA-Level-II Topic 3 Question 63 Discussion

Topic #: 3

Rock Torrey, an analyst for International Retailers Incorporated (IRI), has been asked to evaluate the firm's swap transactions in general, as well as a 2-year fixed for fixed currency swap involving the U .S . dollar and the Mexican peso in particular. The dollar is Torrey's domestic currency, and the exchange rate as of June 1,2009, was $0.0893 per peso. The swap calls for annual payments and exchange of notional principal at the beginning and end of the swap term and has a notional principal of $100 million. The counterparty to the swap is GHS Bank, a large full-service bank in Mexico.

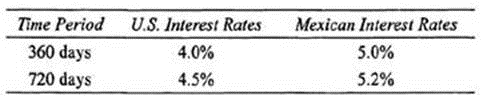

The current term structure of interest rates for both countries is given in the following table:

Torrey believes the swap will help his firm effectively mitigate its foreign currency exposure in Mexico, which sterns mainly from shopping centers in high-end resorts located along the eastern coastline. Having made this conclusion, Torrey begins writing his report for the management of IRI. In addition to the terms of the swap, Torrey includes the following information in the report:

* Implicit in the currency swap under consideration is a swap spread of 75 basis points over 2-year U .S . Treasury securities. This represents a 10 basis point narrowing of the spread as compared to this time last year. Thus, we can assume that the credit risk of the global credit market has decreased. Unfortunately, the decline provides no insight into the credit risk of the individual currency swap with GHS Bank, which could have increased.

* In order to decrease the counterparty default risk on the currency swap, we will need to utilize credit derivatives between the beginning and midpoint of the swap's life when this particular risk is at its highest. This is a significantly different strategy than we normally use with interest rate swaps. For interest rate swaps, counterparty default risk peaks at the middle of the swap's life, at which point we utilize credit derivative CQuntermeasures to offset the risk.

* Because currency swaps almost always include netting agreements and interest rate swaps can be structured to include mark-to-market agreements, we can significantly reduce the credit risk of these swap instruments by negotiating swap contracts that include these respective features. When negotiating these features is not possible, credit risk can be reduced by using off-market swaps that do not require an initial payment from IRI.

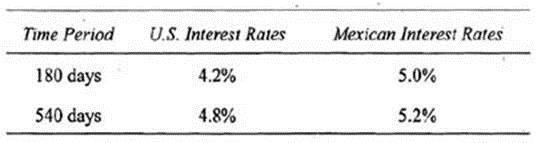

Six months have passed (180 days) since Torrey issued his report to IRI's management team, and the current exchange rate is now $0,085 per peso. The new term structure of interest rates is as follows:

Evaluate Torrey's statements regarding IRPs ability to mitigate the credit risk inherent in currency swaps and interest rate swaps. Torrey is only correct regarding:

Torrey is only correct regarding mark-to-market agreements. Using mark-to-marker agreements for interest rate swaps will reduce credit risk by periodically computing the value of the swap and then requiring payment of that amount by one of the counterparties. At some predetermined time, the swap is revalued according to the new term structure of interest rates, and one party pays the other party any amount due. The swap is then repriced, essentially creating a new swap with no credit risk. Netting payments is also an effective way to reduce credit risk in interest rate and equity swaps. However, currency swap payments are generally not netted. Torrey has incorrectly stated that netting is almost always used in currency swaps. Using off-market swaps is not generally a method to reduce credit risk. If IRI enters into an off-market swap in which they do not owe a payment, then a payment is owed to IRI by the counterparty. This would actually increase credit risk since the counterparty could potentially default on the initial payment. (Study Session 17,'LOS 61A)

Currently there are no comments in this discussion, be the first to comment!