CFA Institute Exam CFA-Level-II Topic 3 Question 39 Discussion

Topic #: 3

Charles Mabry manages a portfolio of equity investments heavily concentrated in the biotech industry. He just returned from an annual meeting among leading biotech analysts in San Francisco. Mabry and other industry experts agree that the latest industry volatility is a result of questionable product safety testing methodologies. While no firms in the industry have escaped the public attention brought on by the questionable safety testing, one company in particular is expected to receive further attention---Biological Instruments Corporation (BIC), one of several long biotech positions in Mabry's portfolio. Several regulatory agencies as well as public interest groups have heavily criticized the rigor of BIC's product safety testing.

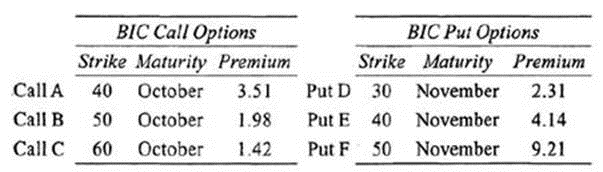

In an effort to manage the risk associated with BIC, Mabry has decided to allocate a portion of his portfolio to options on BIC's common stock. After surveying the derivatives market, Mabry has identified the following European options on BIC common stock:

Mabry wants to hedge the large BIC equity position in his portfolio, which closed yesterday (June 1) at $42 per share. Since Mabry is relatively inexperienced with utilizing derivatives in his portfolios, Mabry enlists the help of an analyst from another firm, James Grimell.

Mabry and Grimell arrange a meeting in Boston where Mabry discusses his expectations regarding the future returns of BIC's equity. Mabry expects BIC equity to make a recovery from the intense market scrutiny but wants to provide his portfolio with a hedge in case BIC has a negative surprise. Grimell makes the following suggestion:

"If you want to avoid selling the BIC position and are willing to earn only the risk-free rate of return, you should sell calls and buy puts on BIC stock with the same market premium. Alternatively, you could buy put options to manage the risk of your portfolio. I recommend waiting until the vega on the options rises, making them less attractive and cheaper to purchase."

Which of the following statements regarding the delta of the BIC options is correct? (Assume that the largest delta is defined as the delta furthest from zero)

An option that is deep in-the-money will have the largest delta. Call options that are deep in-the-money will have a delta close to one, while put options that are deep in-the-money will have a delta close to -1. Options that are out-of-the-money will have deltas close to zero. Put F is the option that is deepest in-the-money, and therefore has the largest delta (even though it is negative, the change in the price of Put F given a change in the price of BIC stock will be larger than any of the other options). Call C is the deepest out-of-the-money option, and thus has the smallest delta. (Study Session 17, LOS 60.e)

Currently there are no comments in this discussion, be the first to comment!