CFA Institute Exam CFA-Level-II Topic 2 Question 62 Discussion

Topic #: 2

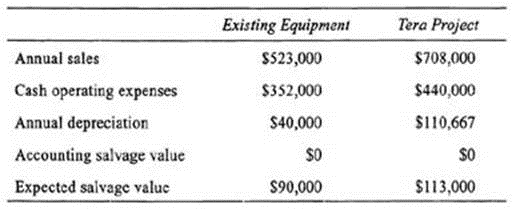

GigaTech Inc. is a large U .S .-based technology conglomerate. The firm has business units in three primary categories: hardware manufacturing, software development, and consulting services. Because of the rapid pace of technological innovation, GigaTech must make capital investments every two to four years. The company has identified several potential investment opportunities for its hardware manufacturing division. The first of these opportunities, Tera Project, would replace a portion of GigaTech's microprocessor assembly equipment with new machinery expected to last three years. The current machinery has a book value of $120,000 and a market value of $195,000. Tcra Project would require purchasing machinery for $332,000, increasing current assets by 5190,000, and increasing current liabilities by $80,000. GigaTech has a tax rate of 40%. Additional pro forma information related to the Tera Project is provided in the following table:

Analysts at GigaTech have noted that investment in the Tera Project can be delayed for up to nine months if managers at the company decide this is necessary. However, once the capital investment is made, the project will be necessary to maintain continuing operations. Tera Project can be scaled up with more equipment requiring less capital than the original investment if results are meeting expectations. In addition, the equipment used in Tera Project can be used in shift work if brief excess demand is expected.

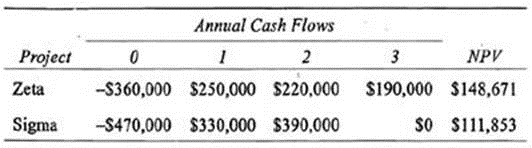

GigaTech is also considering expanding its software development operations in India. Software development equipment must be continually replaced to maintain efficiency as newer and faster technology is developed. The company has identified two mutually exclusive potential expansion projects, Zeta and Sigma. Zeta requires investing in equipment with a 3-year life, while Sigma requires investing in equipment with a 2-year life. GigaTech has estimated real capital costs for the two projects at 10.58%. GigaTech expects inflation to be approximately 4.0% for the foreseeable future. Nominal cash flows and net present values for the Zeta and Sigma projects are provided in the following table:

Recently, GigaTechs board of directors has become concerned with the firm's capital budgeting decisions and has asked management to provide a detailed explanation of the capital budgeting process. After reviewing the report from management, the board makes the following comments in a memo:

* The capital rationing system being utilized is fundamentally flawed since, in some instances, projects that do not increase earnings per share are selected over projects that do increase earnings per share.

* The cash flow projections are flawed since they fail to include costs incurred in the search for projects or the economic consequences of increased competition resulting from highly profitable projects.

* We are making inappropriate investment decisions since the discount rate used to evaluate all potential projects is the firm's weighted average cost of capital.

Which of the following would best correct GigaTech's discount rate problem described in the board of director's memo?

When evaluating pocential capital investment projects, the discount rate should be adjusted for the risk of the project under consideration. This is frequently accomplished by determining a project beta and using this beta in the CAPM security market line equation: + [E( ) - ]. Project betas can be determined in a number of ways including using proxy firms with operations similar to the project under consideration, estimating an accounting beta, or through cross-sectional regression analysis. Whatever method used to determine the discount rate, it should be clear that the weighted average cost of capital (WACC) is only appropriate for projects with risk similar to the overall firm. If a project is more (less) risky than the overall firm, the discount rate used to evaluate the project should be greater (less) than rhe firm's WACC. (Study Session 8, LOS 27-e)

Currently there are no comments in this discussion, be the first to comment!