CFA Institute Exam CFA-Level-II Topic 2 Question 43 Discussion

Topic #: 2

Jonathan Adams, CFA, is doing some scenario analysis on forward contracts. The process involves pricing the forward contracts and then estimating their values based on likely scenarios provided by the firm's forecasting and strategy departments. The forward contracts with which Adams is most concerned are those on fixed income securities, interest rates, and currencies.

The first contract he needs to price is a 270-day forward on a $1 million Treasury bond with ten years remaining to maturity. The bond has a 5% coupon rate, has just made a coupon payment, and will make its next two coupon payments in 182 days and in 365 days. It is currently selling for 98.25. The effective annual risk-free rate is 4%. Adams is also analyzing forward rate agreements (FRAs).

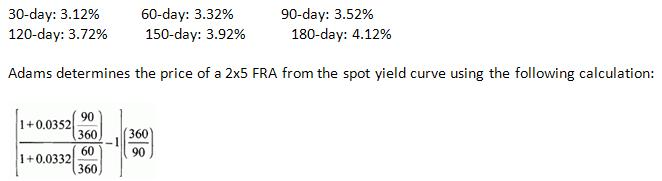

The LIBOR spot curve is as follows:

The LIBOR spot curve is as follows:

Finally, Adams wants to price and value a currency forward on euros. The euro spot rate is $1.1854. The dollar risk-free rate is 3%, and the euro risk-free rate is 4%.

The no-arbitrage price for the forward contract on the Treasury bond is closest to:

The present value of the next coupon payment (per $100 face value) is

(Study Session 16, LOS 58.c)

Currently there are no comments in this discussion, be the first to comment!