CFA Institute Exam CFA-Level-II Topic 1 Question 50 Discussion

Topic #: 1

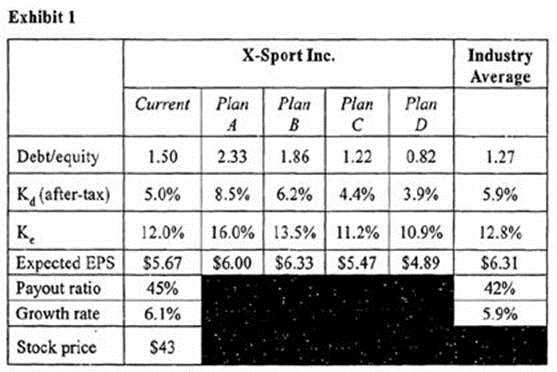

James Kelley is the CFO of X-Sport Inc., a manufacturer of high-end outdoor sporting equipment. Using both debt and equity, X-Sport has been acquiring small competitor companies rather rapidly over the past few years, leading Kelley to believe that the firm's capital structure may have drifted from its optimal mix. Kelley has been asked by the board of directors to evaluate the situation and provide a presentation that includes details of the firm's capita! structure as well as a risk assessment. In order to assist with his analysis, Kelley has collected information on the current financial situation of X-Sport. He has also projected the financial information for alternative financing plans. This information is presented in Exhibit 1.

After carefully analyzing the data, Kelley writes his analysis and proposal and submits the report to Richard Haywood, the chairman and CEO of X-Sport Inc. Excerpts from the analysis and proposal follow:

* In selecting a re-financing plan, we must not push our leverage ratio too high. An overly aggressive leverage ratio will likely cause debt rating agencies to downgrade our debt rating from its current Baa rating, causing our cost of debt to rise dramatically. This effect is explained using the static trade-off capital structure theory, which states that if our debt usage becomes high enough, the marginal increase in the interest tax shield will be more than The marginal increase in the costs of financial distress. However, using some additional leverage will benefit the company by reducing the net agency costs of equity required to align the interests of X-Sport management with its shareholders.

* In the event that X-Sport decides to proceed with a recapitalization plan, I recommend Plan D since it is the most consistent with the shareholders' interests.

Haywood reviews the report and calls Kelley into his office to discuss the proposal. Haywood suggests that Flan B would be the most appropriate choice for adjusting X-Sport's capital structure. Before Kelley can argue, however, the two are interrupted by a previously scheduled meeting with a supplier.

Haywood takes Kelley's data and proposes to the board of directors that X-Sport pursue one of three alternatives to restructure the company. The first alternative is Plan B from Kelley's analysis. The second alternative involves separating GearTech, one of the companies acquired over the last few years, from the rest of the company by issuing new GearTech shares to X-Sport common shareholders. The third alternative involves creating a new company, Euro-Sport, out of the firm's European operations and selling 35% of the new Euro-Sport shares to the public while retaining 65% of the shares within X-Sport. After some persuading, Haywood convinces the seven-member board (two of whom were former executives at GearTech) to accept the second alternative, which he had favored from the beginning. The board puts together an announcement to its shareholders as well as the general public, detailing the terms and goals of the plan.

A group of shareholders, upset about the board's plan, submit a formal objection to X-Sport's board as well as to the SEC. In the objection, the shareholders state that the independence of the board has been compromised to the detriment of the company and its shareholders. The objection also states that:

* The value of X-Sport's common stock has been impaired as a result of the poor corporate governance system.

* The liability risk of X-Sport has increased due to the increased possibility of future transactions that benefit X-Sport's directors, without regard to the long-term interests of shareholders.

* The asset risk of X-Sport has increased due to the inability of investors to trust the GearTech financial disclosures necessary to value the division.

Using the information in Exhibit 1, calculate X-Sport's weighted average cost of capital for the optimal capital structure.

Begin by calculating the capital structure of each plan and then multiply the percentage of debt and equity by their component costs and add the results to find the weighted average cost of capital (WACC). The plan with the lowest WACC maximizes the firms stock price and thus reflects the optimal capital structure. In this case, Plan C meets all of the criteria for optimizing X-Sport's capital structure. Plan C's debt to equity ratio is 1.22. Thus, there are 1.22 units of debt for every one unit of equity for a total of 2.22 units of capital. Therefore, the percentage debt is 1.22 / 2.22 = 55%, leaving 45% equity. Thus', the WACC for Plan C is: (0.55 x 4.4%) + (0.45 x 11.2%) = 7.46%.

Repeating these calculations for Plans A, B, and D, we find that the WACCs arc 10.75%, 8.76%, and 7.75%, respectively. (Study Session 8, LOS 28.g)

Currently there are no comments in this discussion, be the first to comment!