CFA Institute Exam CFA-Level-II Topic 1 Question 10 Discussion

Topic #: 1

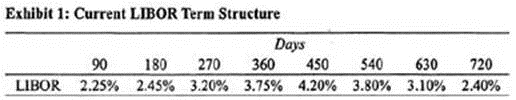

William Bow, CFA, is a risk manager for GlobeCorp, an international conglomerate with operations in the technology, consumer products, and medical devices industries. Exactly one year ago, GlobeCorp, under Bow's advice, entered into a 3-year payer interest rate swap with semiannual floating rate payments based on the London interbank offered rate (LIBOR) and semiannual fixed rate payments based on an annual rate of 2.75%. At the time of initiation, the swap had a value of zero and the notional principal was set equal to $150 million. The counterparty to GlobeCorp's swap is NVS Bank, a commercial bank that also serves as a swap dealer. Exhibit 1 below summarizes the current LIBOR term structure.

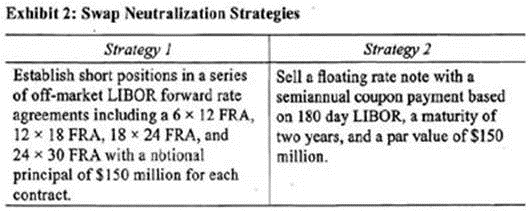

Upper management at GlobeCorp feels that the original swap has served its intended purpose but that circumstances have changed and it is now time to offset the firm's exposure to the swap. Because they cannot find a counterparty to an offsetting swap transaction, management has asked Bow to come up with alternative measures to offset the swap exposure. Bow created a report for the management team which outlines several strategies to neutralize the swap exposure. Two of his strategies are included in Exhibit 2.

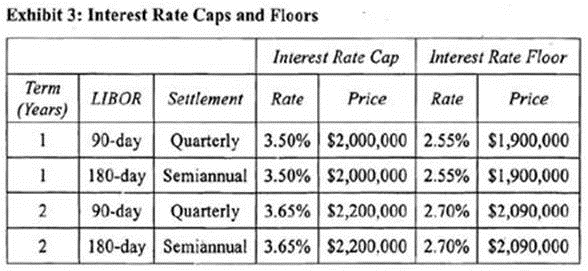

After examining its long-term liabilities, NVS Bank has decided that it currently needs to borrow $100 million over the next two years to finance its operations. For this type of funding need, NVS generally issues quarterly coupon short-term floating rate notes based on 90-day LIBOR. NVS is concerned, however, that interest rates may shift upward and the LIBOR curve may become upward sloping. To manage this risk, NVS is considering utilizing interest rate derivatives. Managers at the bank have collected quotes on over-the-counter interest rate caps and floors from a well known securities dealer. The quotes, which are based on a notional principal of $100 million, are provided in Exhibit 3.

One of the managers at NVS Bank, Lois Green, has expressed her distrust of the securities dealer quoting prices on the caps and floors. In a memo to the CFO, Green suggested that NVS use an alternative but equivalent approach to manage the interest rate risk associated with its two-year funding plan. Following is an excerpt from Green's memo:

"Rather than using a cap or floor, NVS Bank can effectively manage its exposure to interest rates resulting from the 2-year funding requirement by taking long positions in a series of put options on fixed-income instruments with expiration dates that coincide with the payment dates on the floating rate note."

"As a cheaper alternative, NVS can effectively manage its exposure to interest rates resulting from the 2-ycar funding requirement by creating a collar using long positions in a series of call options on interest rates and long positions in a series of call options on fixed income instruments all of which would have expiration dates that coincide with the payment dates on the floating rate note."

Calculate the expected payoff after 720 days from a short position in the 2-year semiannual interest rate floor in Exhibit 3 if LIBOR at that time is expected to be 2.40%.

The writer or seller of a floor (i.e., the short position) receives the premium or fee from the buyer of the floor. This fee is the maximum gain that the seller can achieve. The seller will be forced to make a payment to the buyer if the floor expires in the money. For a floor to be in the money, the reference rate (LIBOR in this case) must be below the contract rate. The contract rate on the 2-year semiannual floor is 2.70% which is greater than the expected LIBOR rate of 2.40% after 720 days. Therefore, the floor is in the money and the seller must make a payment to the buyer. The payment is calculated as follows:

Note that the purchaser of the floor in this scenario would receive a positive $150,000 payoff.

(Study Session 17, LOS 62.b)

Currently there are no comments in this discussion, be the first to comment!