Free CFA Institute CFA-Level-II Exam Dumps

Here you can find all the free questions related with CFA Institute CFA Level II Chartered Financial Analyst (CFA-Level-II) exam. You can also find on this page links to recently updated premium files with which you can practice for actual CFA Institute CFA Level II Chartered Financial Analyst Exam. These premium versions are provided as CFA-Level-II exam practice tests, both as desktop software and browser based application, you can use whatever suits your style. Feel free to try the CFA Level II Chartered Financial Analyst Exam premium files for free, Good luck with your CFA Institute CFA Level II Chartered Financial Analyst Exam.MultipleChoice

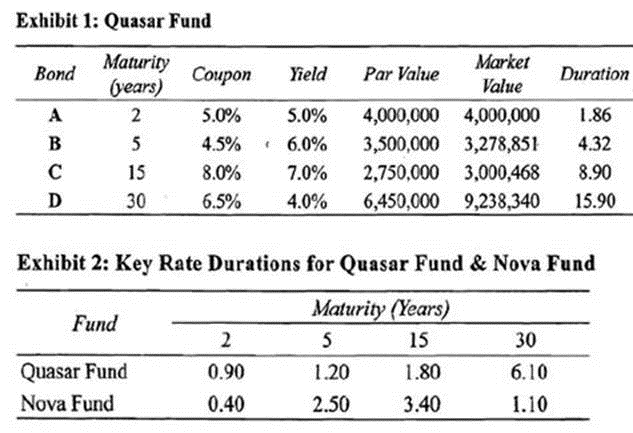

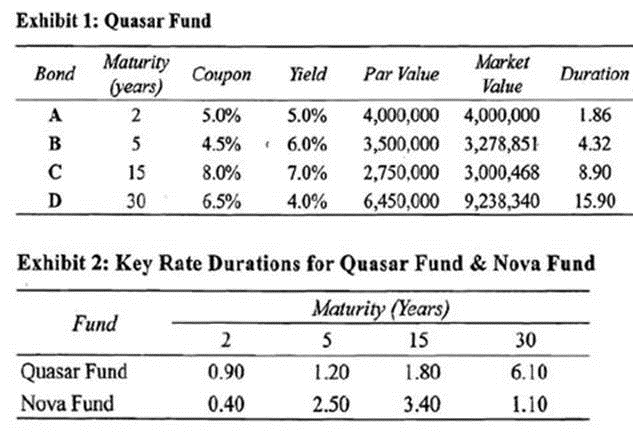

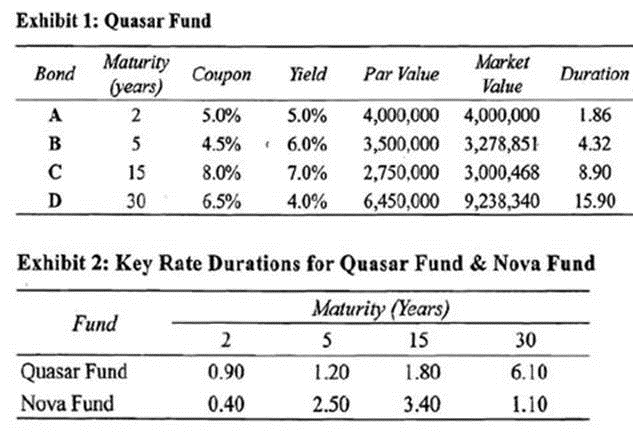

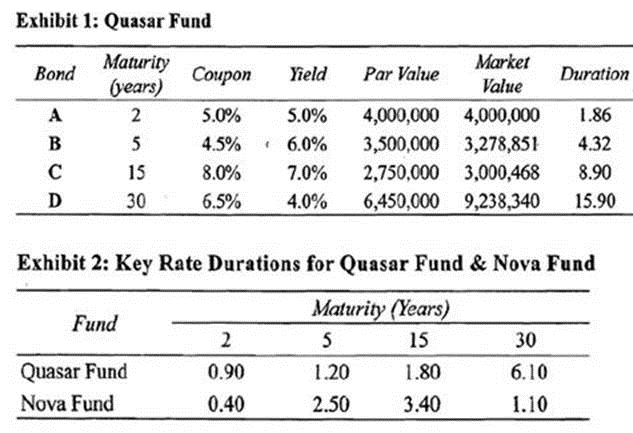

Martha Garret, CFA, manages fixed income portfolios for Jones Brothers, Inc. (JBI). JBI has been in the portfolio management business for over 23 years and provides investors with access to actively managed equity and fixed-income portfolios. All of JBI's fixed-income portfolios are constructed using U .S . debt instruments. Garret's primary portfolio responsibilities are the Quasar Fund and the Nova Fund, both of which are long fixed-income portfolios consisting of Treasury securities in all maturity ranges. The Quasar Fund holdings as of March 15 are provided in Exhibit 1. A comparison of key rate durations for the Quasar Fund and Nova Fund is provided in Exhibit 2.

Of particular importance to Garret and her colleagues is the degree of interest rate risk exposure unique to each portfolio under JBI's management. Driving the increased awareness of the portfolios' interest rate exposure is the double digit growth in assets under management that JBI's fixed-income portfolios have experienced in the last five years. Interest in the company's fixed-income portfolios continues to grow and as a result, all portfolio managers are required to attend weekly meetings to discuss key portfolio risk factors. At the last meeting, Miranda Walsh, a principal at JBI, made the following comments:

"The variance of daily interest rate changes has been trending higher over the last three months leading us to believe that a period of high volatility is approaching in the next twelve to eighteen months. However, the reliability is questionable since the volatility estimates were derived using an option pricing model, which assumes constant interest rates."

"Also, the Treasury spot rate curve currently has a similar shape to the yield curve on Treasury coupon securities, which, according to the market segmentation theory of interest rate term structure, indicates a relatively high level of demand from investors for intermediate term securities. Overzealous trading by investors unwilling to move into other maturity ranges may create mispricing and opportunities for arbitrage."

After the meeting, Walsh and JBI's other principals met to discuss a new international portfolio opportunity. At Walsh's suggestion, the principals selected Garret as the lead portfolio manager for the new fund, which will be titled the Atlantic Fund. One of the other portfolio managers, Greg Terry, CFA, suggested to Garret that she utilize the LIBOR swap curve as a benchmark for the Atlantic fund rather than using local government yield curves. Terry justifies his suggestion by claiming that "the lack of government regulation in the swap market makes swap rates and curves directly comparable between different countries despite fewer maturity points with which to construct the curve as compared to a government yield curve. Furthermore, credit risk in the swap curves of various countries is similar, thus avoiding the complications associated with different levels of sovereign risk embedded in government yield curves.'' Intrigued by the idea of using the swap curve, Garret has her assistant begin gathering a range of current and forward LIBOR rates.

Calculate the effect of a 75 basis point decrease in the 15-year interest rate and a 50 basis point increase in the 2-year interest rate on the value of the Nova Fund.

OptionsMultipleChoice

Martha Garret, CFA, manages fixed income portfolios for Jones Brothers, Inc. (JBI). JBI has been in the portfolio management business for over 23 years and provides investors with access to actively managed equity and fixed-income portfolios. All of JBI's fixed-income portfolios are constructed using U .S . debt instruments. Garret's primary portfolio responsibilities are the Quasar Fund and the Nova Fund, both of which are long fixed-income portfolios consisting of Treasury securities in all maturity ranges. The Quasar Fund holdings as of March 15 are provided in Exhibit 1. A comparison of key rate durations for the Quasar Fund and Nova Fund is provided in Exhibit 2.

Of particular importance to Garret and her colleagues is the degree of interest rate risk exposure unique to each portfolio under JBI's management. Driving the increased awareness of the portfolios' interest rate exposure is the double digit growth in assets under management that JBI's fixed-income portfolios have experienced in the last five years. Interest in the company's fixed-income portfolios continues to grow and as a result, all portfolio managers are required to attend weekly meetings to discuss key portfolio risk factors. At the last meeting, Miranda Walsh, a principal at JBI, made the following comments:

"The variance of daily interest rate changes has been trending higher over the last three months leading us to believe that a period of high volatility is approaching in the next twelve to eighteen months. However, the reliability is questionable since the volatility estimates were derived using an option pricing model, which assumes constant interest rates."

"Also, the Treasury spot rate curve currently has a similar shape to the yield curve on Treasury coupon securities, which, according to the market segmentation theory of interest rate term structure, indicates a relatively high level of demand from investors for intermediate term securities. Overzealous trading by investors unwilling to move into other maturity ranges may create mispricing and opportunities for arbitrage."

After the meeting, Walsh and JBI's other principals met to discuss a new international portfolio opportunity. At Walsh's suggestion, the principals selected Garret as the lead portfolio manager for the new fund, which will be titled the Atlantic Fund. One of the other portfolio managers, Greg Terry, CFA, suggested to Garret that she utilize the LIBOR swap curve as a benchmark for the Atlantic fund rather than using local government yield curves. Terry justifies his suggestion by claiming that "the lack of government regulation in the swap market makes swap rates and curves directly comparable between different countries despite fewer maturity points with which to construct the curve as compared to a government yield curve. Furthermore, credit risk in the swap curves of various countries is similar, thus avoiding the complications associated with different levels of sovereign risk embedded in government yield curves.'' Intrigued by the idea of using the swap curve, Garret has her assistant begin gathering a range of current and forward LIBOR rates.

Which of the following statements regarding the effects of interest rate changes on the Quasar Fund and Nova Fund is most accurate? The value of the:

OptionsMultipleChoice

Martha Garret, CFA, manages fixed income portfolios for Jones Brothers, Inc. (JBI). JBI has been in the portfolio management business for over 23 years and provides investors with access to actively managed equity and fixed-income portfolios. All of JBI's fixed-income portfolios are constructed using U .S . debt instruments. Garret's primary portfolio responsibilities are the Quasar Fund and the Nova Fund, both of which are long fixed-income portfolios consisting of Treasury securities in all maturity ranges. The Quasar Fund holdings as of March 15 are provided in Exhibit 1. A comparison of key rate durations for the Quasar Fund and Nova Fund is provided in Exhibit 2.

Of particular importance to Garret and her colleagues is the degree of interest rate risk exposure unique to each portfolio under JBI's management. Driving the increased awareness of the portfolios' interest rate exposure is the double digit growth in assets under management that JBI's fixed-income portfolios have experienced in the last five years. Interest in the company's fixed-income portfolios continues to grow and as a result, all portfolio managers are required to attend weekly meetings to discuss key portfolio risk factors. At the last meeting, Miranda Walsh, a principal at JBI, made the following comments:

"The variance of daily interest rate changes has been trending higher over the last three months leading us to believe that a period of high volatility is approaching in the next twelve to eighteen months. However, the reliability is questionable since the volatility estimates were derived using an option pricing model, which assumes constant interest rates."

"Also, the Treasury spot rate curve currently has a similar shape to the yield curve on Treasury coupon securities, which, according to the market segmentation theory of interest rate term structure, indicates a relatively high level of demand from investors for intermediate term securities. Overzealous trading by investors unwilling to move into other maturity ranges may create mispricing and opportunities for arbitrage."

After the meeting, Walsh and JBI's other principals met to discuss a new international portfolio opportunity. At Walsh's suggestion, the principals selected Garret as the lead portfolio manager for the new fund, which will be titled the Atlantic Fund. One of the other portfolio managers, Greg Terry, CFA, suggested to Garret that she utilize the LIBOR swap curve as a benchmark for the Atlantic fund rather than using local government yield curves. Terry justifies his suggestion by claiming that "the lack of government regulation in the swap market makes swap rates and curves directly comparable between different countries despite fewer maturity points with which to construct the curve as compared to a government yield curve. Furthermore, credit risk in the swap curves of various countries is similar, thus avoiding the complications associated with different levels of sovereign risk embedded in government yield curves.'' Intrigued by the idea of using the swap curve, Garret has her assistant begin gathering a range of current and forward LIBOR rates.

Evaluate Walsh's comments regarding the method used to estimate the expected increase in interest rate volatility and the term structure of interest rates.

OptionsMultipleChoice

Martha Garret, CFA, manages fixed income portfolios for Jones Brothers, Inc. (JBI). JBI has been in the portfolio management business for over 23 years and provides investors with access to actively managed equity and fixed-income portfolios. All of JBI's fixed-income portfolios are constructed using U .S . debt instruments. Garret's primary portfolio responsibilities are the Quasar Fund and the Nova Fund, both of which are long fixed-income portfolios consisting of Treasury securities in all maturity ranges. The Quasar Fund holdings as of March 15 are provided in Exhibit 1. A comparison of key rate durations for the Quasar Fund and Nova Fund is provided in Exhibit 2.

Of particular importance to Garret and her colleagues is the degree of interest rate risk exposure unique to each portfolio under JBI's management. Driving the increased awareness of the portfolios' interest rate exposure is the double digit growth in assets under management that JBI's fixed-income portfolios have experienced in the last five years. Interest in the company's fixed-income portfolios continues to grow and as a result, all portfolio managers are required to attend weekly meetings to discuss key portfolio risk factors. At the last meeting, Miranda Walsh, a principal at JBI, made the following comments:

"The variance of daily interest rate changes has been trending higher over the last three months leading us to believe that a period of high volatility is approaching in the next twelve to eighteen months. However, the reliability is questionable since the volatility estimates were derived using an option pricing model, which assumes constant interest rates."

"Also, the Treasury spot rate curve currently has a similar shape to the yield curve on Treasury coupon securities, which, according to the market segmentation theory of interest rate term structure, indicates a relatively high level of demand from investors for intermediate term securities. Overzealous trading by investors unwilling to move into other maturity ranges may create mispricing and opportunities for arbitrage."

After the meeting, Walsh and JBI's other principals met to discuss a new international portfolio opportunity. At Walsh's suggestion, the principals selected Garret as the lead portfolio manager for the new fund, which will be titled the Atlantic Fund. One of the other portfolio managers, Greg Terry, CFA, suggested to Garret that she utilize the LIBOR swap curve as a benchmark for the Atlantic fund rather than using local government yield curves. Terry justifies his suggestion by claiming that "the lack of government regulation in the swap market makes swap rates and curves directly comparable between different countries despite fewer maturity points with which to construct the curve as compared to a government yield curve. Furthermore, credit risk in the swap curves of various countries is similar, thus avoiding the complications associated with different levels of sovereign risk embedded in government yield curves.'' Intrigued by the idea of using the swap curve, Garret has her assistant begin gathering a range of current and forward LIBOR rates.

Which of the following best evaluates Terry's justification for using the swap curve as the benchmark for the Atlantic Fund? Terry's justification is:

Options