Deal of The Day! Hurry Up, Grab the Special Discount - Save 25% - Ends In 00:00:00 Coupon code: SAVE25

AIWMI Exam CCRA-L2 Topic 2 Question 32 Discussion

Actual exam question for

AIWMI's

CCRA-L2 exam

Question #: 32

Topic #: 2

[All CCRA-L2 Questions]

Topic #: 2

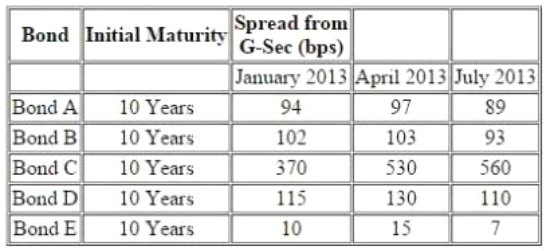

The following information pertains to bonds:

Further following information is available about a particular bond 'Bond F'

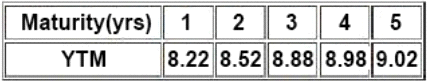

There is a 10.25% risky bond with a maturity of 2.25% year(s) its current price is INR105.31, which ccorresponds to YTM of 9.22%. The following are the benchmark YTMs.

Assume that the general market rates have increased. An issuer, Revolution Ltd has plans to roll over its existing commercial paper and forth coming reset dates for its floating rate bonds are very near. Which of the following ratios for revolution will get impacted?

Suggested Answer:

A

Currently there are no comments in this discussion, be the first to comment!