Deal of The Day! Hurry Up, Grab the Special Discount - Save 25% - Ends In 00:00:00 Coupon code: SAVE25

AIWMI Exam CCRA-L2 Topic 1 Question 42 Discussion

Actual exam question for

AIWMI's

CCRA-L2 exam

Question #: 42

Topic #: 1

[All CCRA-L2 Questions]

Topic #: 1

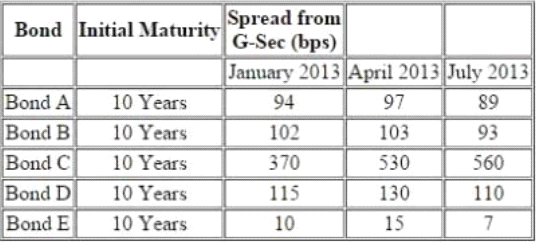

The following information pertains to bonds:

Further following information is available about a particular bond 'Bond F'

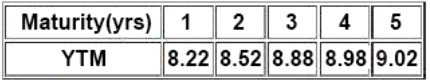

There is a 10.25% risky bond with a maturity of 2.25% year(s) its current price is INR105.31, which corresponds to YTM of 9.22%. The following are the benchmark YTMs.

Compute interpolated spread for Bond F based on the information provided in the vignette:

Suggested Answer:

A

Currently there are no comments in this discussion, be the first to comment!