AICPA CPA-Regulation Exam Questions

- Topic 1: Review engagement and evaluate information

- Topic 2: Planning and measurement

- Topic 3: Accounting and reporting for governmental entities.

Free AICPA CPA-Regulation Exam Actual Questions

Note: Premium Questions for CPA-Regulation were last updated On Jul. 09, 2025 (see below)

The uniform capitalization method must be used by:

I Manufacturers of tangible personal property.

II Retailers of personal property with $2 million dollars in average annual gross receipts for the 3 preceding years.

Choice 'a' is correct. I only.

Rule: The uniform capitalization rules apply to the following:

1. Real or tangible personal property produced by the taxpayer for use in a trade or business.

2. Real or tangible personal property produced by the taxpayer for sale to customers.

3. Real or personal property acquired by the taxpayer for resale.

4. However, the uniform capitalization rules do not apply to property acquired for resale if the taxpayer's annual gross receipts for the preceding three tax years do not exceed $10,000,000 (not $2 million).

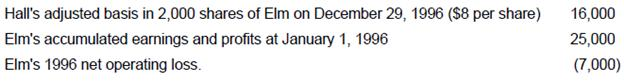

Elm Corp. is an accrual-basis calendar-year C corporation with 100,000 shares of voting common stock issued and outstanding as of December 28, 1996. On Friday, December 29, 1996, Hall surrendered 2,000 shares of Elm stock to Elm in exchange for $33,000 cash. Hall had no direct or indirect interest in Elm after the stock surrender. Additional information follows:

What amount of income did Hall recognize from the stock surrender?

Choice 'd' is correct. $17,000 capital gain.

Amount realized:

Choices 'a' and 'b' are incorrect. Dividends are distributions of earnings. These proceeds are from the sale of stock.

Choice 'c' is incorrect, per above. Accumulated earnings and profits do not effect the gain calculation, they only affect the taxability of dividends paid to shareholders.

Tom and Joan Moore, both CPAs, filed a joint 1994 federal income tax return showing $70,000 in taxable income. During 1994, Tom's daughter Laura, age 16, resided with Tom. Laura had no income of her own and was Tom's dependent.

Determine the amount of income or loss, if any that should be included on page one of the Moores' 1994 Form 1040.

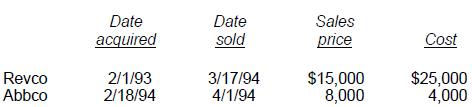

The Moores had no capital loss carryovers from prior years. During 1994, the Moores had the following stock transactions, which resulted in a net capital loss:

'J' is correct. $3,000. The capital loss on Revco ($10,000 loss) is added to the capital gain on Abbco ($4,000) to produce a net capital loss of ($6,000). The Moores can claim $3,000 of the loss on their 1994 income tax return and carry the balance forward to 1995.

Tom and Joan Moore, both CPAs, filed a joint 1994 federal income tax return showing $70,000 in taxable income. During 1994, Tom's daughter Laura, age 16, resided with Tom. Laura had no income of her own and was Tom's dependent.

Determine the amount of income or loss, if any that should be included on page one of the Moores' 1994 Form 1040.

In 1992, Joan received an acre of land as an inter-vivos gift from her grandfather. At the time of the gift, the land had a fair market value of $50,000. The grandfather's adjusted basis was $60,000. Joan sold the land in 1994 to an unrelated third party for $56,000.

'A' is correct. $0. Property received by gift has two bases: one for computing gain and another for computing loss. Joan's basis for gain is the grandfather's adjusted basis ($60,000). Using this basis for gain, Joan has a loss of: $56,000 - $60,000 = ($4,000 loss). Joan's basis for loss is the fair market value of the property on the date of the gift ($50,000). Using this basis for loss, Joan has a gain of: $56,000 - $50,000 = $6,000 gain. In this unusual situation, Joan has neither a gain nor a loss, although the transaction must be reported.

Tom and Joan Moore, both CPAs, filed a joint 1994 federal income tax return showing $70,000 in taxable income. During 1994, Tom's daughter Laura, age 16, resided with Tom. Laura had no income of her own and was Tom's dependent.

Determine the amount of income or loss, if any that should be included on page one of the Moores' 1994 Form 1040.

The Moores received a $500 security deposit on their rental property in 1994. They are required to return the amount to the tenant.

'A' is correct. $0. The security deposit is not taxable income because the Moores are required to return it when the tenant leaves. If the deposit is applied to damages in a later tax year, the portion the Moores retain would be income to them in the year they retain the deposit, and the money they spend to repair the damage would be a deduction to them.

- Select Question Types you want

- Set your Desired Pass Percentage

- Allocate Time (Hours : Minutes)

- Create Multiple Practice tests with Limited Questions

- Customer Support

Basilia

22 days agoLevi

30 days agoWava

2 months agoMaryann

2 months agoDaren

2 months agoKati

3 months agoEveline

3 months agoVannessa

3 months agoAudry

4 months agoJaclyn

4 months agoDaniela

4 months agoShawn

5 months agoRolf

5 months agoAngella

5 months agoJettie

5 months agoJulie

6 months agoAlfreda

6 months agoDetra

6 months agoBettye

7 months agoSage

7 months agoDortha

7 months agoAnnamaria

7 months agoAshley

7 months agoMatthew

8 months agoMiriam

8 months agoMarshall

8 months agoYuette

8 months agoHubert

8 months agoTiara

9 months agoBarrie

9 months agoGianna

9 months agoEnola

9 months agoElina

9 months agoCarman

10 months agoErasmo

10 months agoGlory

10 months agoGwenn

11 months agoDaren

11 months agoCraig

1 years agoLisbeth

1 years ago