AICPA Exam CPA-Regulation Topic 3 Question 51 Discussion

Topic #: 3

Tom and Joan Moore, both CPAs, filed a joint 1994 federal income tax return showing $70,000 in taxable income. During 1994, Tom's daughter Laura, age 16, resided with Tom. Laura had no income of her own and was Tom's dependent.

Determine the amount of income or loss, if any that should be included on page one of the Moores' 1994 Form 1040.

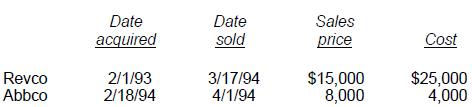

The Moores had no capital loss carryovers from prior years. During 1994, the Moores had the following stock transactions, which resulted in a net capital loss:

'J' is correct. $3,000. The capital loss on Revco ($10,000 loss) is added to the capital gain on Abbco ($4,000) to produce a net capital loss of ($6,000). The Moores can claim $3,000 of the loss on their 1994 income tax return and carry the balance forward to 1995.

Currently there are no comments in this discussion, be the first to comment!