AICPA Exam CPA-Regulation Topic 3 Question 4 Discussion

Topic #: 3

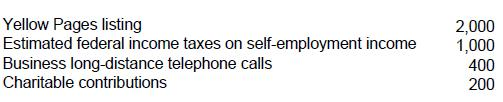

Rich is a cash basis self-employed air-conditioning repairman with 1993 gross business receipts of $20,000. Rich's cash disbursements were as follows:

What amount should Rich report as net self-employment income?

Choice "a" is correct. Deductions to arrive at net self-employed income include all necessary and ordinary expenses connected with the business. Estimated federal income tax payments are not an expense. Charitable contributions by an individual are only deductible as an itemized deduction on Schedule A. This assumes the contribution was not made with the "expectation of commensurate financial return."

Choice "b" is incorrect. Charitable contributions are an itemized deduction unless there is an expectation of commensurate financial return.

Choice "c" is incorrect. Federal income taxes paid are not a deductible expense.

Choice "d" is incorrect. Charitable contributions are an itemized deduction unless there is an expectation of commensurate financial return. Federal income taxes paid are not a deductible expense.

Currently there are no comments in this discussion, be the first to comment!