AICPA Exam CPA-Regulation Topic 3 Question 16 Discussion

Topic #: 3

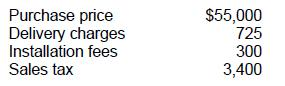

Starr, a self-employed individual, purchased a piece of equipment for use in Starr's business. The costs associated with the acquisition of the equipment were:

What is the depreciable basis of the equipment?

Choice 'd' is correct. The rules for depreciable basis in tax are generally the same as the GAAP rules for capitalizing an asset. The depreciable basis is the cost associated with the purchase of the asset and with getting the asset ready for its intended use. Further improvements are also capitalized, and the basis is reduced for any accumulated depreciation. In this case, the cost of obtaining the equipment and getting the equipment ready for its intended use includes all the items shown above, as follows:

Choice 'a' is incorrect. The costs of delivery charges, installation, and sales tax are all part of the cost of obtaining the asset and getting the asset ready for its intended use. All of these charges are included in the depreciable basis of the equipment.

Choice 'b' is incorrect. The costs of delivery charges and installation are both part of the cost of obtaining the asset and getting the asset ready for its intended use. These charges are included in the depreciable basis of the equipment.

Choice 'c' is incorrect. The cost of installation is part of the cost getting the asset ready for its intended use. This charge is included in the depreciable basis of the equipment.

Currently there are no comments in this discussion, be the first to comment!