Deal of The Day! Hurry Up, Grab the Special Discount - Save 25% - Ends In 00:00:00 Coupon code: SAVE25

AICPA Exam CPA-Regulation Topic 3 Question 1 Discussion

Actual exam question for

AICPA's

CPA-Regulation exam

Question #: 1

Topic #: 3

[All CPA-Regulation Questions]

Topic #: 3

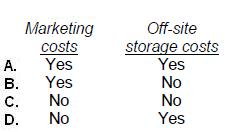

Under the uniform capitalization rules applicable to property acquired for resale, which of the following costs should be capitalized with respect to inventory if no exceptions are met?

Suggested Answer:

D

Choice "d" is correct. Under the uniform capitalization rules, purchasers of inventory for resale may deduct their marketing costs but must capitalize their off-site storage costs.

Choices "a", "b", and "c" are incorrect. Marketing costs are deductible, but off-site storage must be capitalized.

Currently there are no comments in this discussion, be the first to comment!