AICPA Exam CPA-Regulation Topic 2 Question 42 Discussion

Topic #: 2

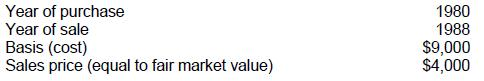

Doris and Lydia are equal partners in the capital and profits of Agee & Nolan, but are otherwise unrelated. The following information pertains to 300 shares of Mast Corp. stock sold by Lydia to Agee & Nolan:

The amount of long-term capital loss that Lydia realized in 1988 on the sale of this stock was:

Choice 'a' is correct. $5,000 long term capital loss 'realized' in 1988 by Lydia. Be careful, and always check the question being asked. In this case, the question is how much of a capital loss Lydia realized in 1988.

Choice 'b' is incorrect. $3,000 represents the portion of the $5,000 realized loss that would currently be recognized unless there were additional capital transactions resulting in gains. Remember that the deduction for capital losses for an individual is limited to $3,000 each year.

Choice 'c' is incorrect. $2,500 represents the pre-1986 portion of the $5,000 realized loss that would have given rise to a recognized loss. Pre-1986 law required $2 of net long term loss to give the benefit of $1 of tax deduction. Current law gives a dollar-for-dollar deduction limited to $3,000 in any year.

Choice 'd' is incorrect. $0 would have been the amount of loss recognized if Lydia owned more than a 50% interest in the partnership. Losses realized on transactions between a partnership and a partner owning more than a 50% interest are not deductible as the parties would be considered related and any realized loss would be disallowed.

Currently there are no comments in this discussion, be the first to comment!