AICPA Exam CPA-Regulation Topic 2 Question 26 Discussion

Topic #: 2

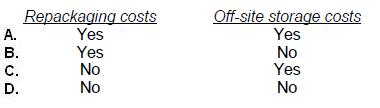

Under the uniform capitalization rules applicable to taxpayers with property acquired for resale, which of the following costs should be capitalized with respect to inventory if no exceptions have been met?

Choice 'a' is correct. Direct material, direct labor, and factory overhead (applicable indirect costs) are capitalized with respect to inventory under the uniform capitalization rules for property acquired for resale. Applicable indirect costs include depreciation and amortization, insurance, supervisory wages, utilities, spoilage and scrap, design expenses, repair and maintenance and rental of equipment and facilities (including offsite storage), some administrative costs, costs of bonus and other incentive plans, and indirect supplies and other materials (including repackaging costs).

Choices 'b', 'c', and 'd' are incorrect, per the above discussion.

Individual Taxation - Capital Gains and Losses

Currently there are no comments in this discussion, be the first to comment!