AICPA Exam CPA-Regulation Topic 1 Question 52 Discussion

Topic #: 1

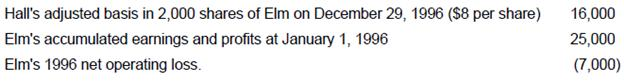

Elm Corp. is an accrual-basis calendar-year C corporation with 100,000 shares of voting common stock issued and outstanding as of December 28, 1996. On Friday, December 29, 1996, Hall surrendered 2,000 shares of Elm stock to Elm in exchange for $33,000 cash. Hall had no direct or indirect interest in Elm after the stock surrender. Additional information follows:

What amount of income did Hall recognize from the stock surrender?

Choice 'd' is correct. $17,000 capital gain.

Amount realized:

Choices 'a' and 'b' are incorrect. Dividends are distributions of earnings. These proceeds are from the sale of stock.

Choice 'c' is incorrect, per above. Accumulated earnings and profits do not effect the gain calculation, they only affect the taxability of dividends paid to shareholders.

Currently there are no comments in this discussion, be the first to comment!