Deal of The Day! Hurry Up, Grab the Special Discount - Save 25% - Ends In 00:00:00 Coupon code: SAVE25

AICPA Exam CPA-Regulation Topic 1 Question 33 Discussion

Actual exam question for

AICPA's

CPA-Regulation exam

Question #: 33

Topic #: 1

[All CPA-Regulation Questions]

Topic #: 1

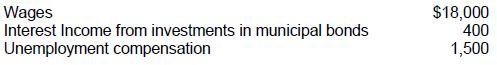

During 2001, Adler had the following cash receipts:

What is the total amount that must be included in gross income on Adler's 2001 income tax return?

Suggested Answer:

C

Choice 'c' is correct. The wages of $18,000 and unemployment compensation are both includable in gross income on Adler's 2001 income tax return.

Choice 'a' is incorrect. The unemployment compensation must be included in gross income.

Choice 'b' is incorrect. Municipal bond interest income is excluded from gross income and the unemployment compensation must be included in gross income.

Choice 'd' is incorrect. Municipal bond interest income is excluded from gross income.

Currently there are no comments in this discussion, be the first to comment!