AICPA Exam CPA-Regulation Topic 1 Question 20 Discussion

Topic #: 1

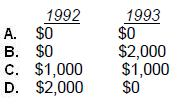

Smith, an individual calendar-year taxpayer, purchased 100 shares of Core Co. common stock for $15,000 on December 15, 1992, and an additional 100 shares for $13,000 on December 30, 1992. On January 3, 1993, Smith sold the shares purchased on December 15, 1992, for $13,000. What amount of loss from the sale of Core's stock is deductible on Smith's 1992 and 1993 income tax returns?

Choice 'a' is correct. In 1992, no sale of stock occurred so there would be no loss. In 1993, there is a $2,000 loss realized ($15,000 basis less $13,000 received), but it is not deductible because it is a wash sale. A wash sale occurs when a taxpayer sells stock at a loss and invests in substantially identical stock within 30 days before or after the sale. In this case, Smith reinvested in an additional 100 shares four days prior to selling 100 shares of the same stock at a loss. The $2,000 disallowed loss would, however, increase the basis of the new shares by $2,000.

Choice 'b' is incorrect. The $2,000 loss realized in 1993 is disallowed under the wash sale rules.

Choice 'c' is incorrect. In 1992, there is no loss since no shares were sold. In 1993, the $2,000 loss is disallowed under the wash sale rules.

Choice 'd' is incorrect. In 1992, there is no possible loss since no shares were sold.

Currently there are no comments in this discussion, be the first to comment!