Deal of The Day! Hurry Up, Grab the Special Discount - Save 25% - Ends In 00:00:00 Coupon code: SAVE25

AICPA Exam CPA-Financial Topic 3 Question 43 Discussion

Actual exam question for

AICPA's

CPA-Financial exam

Question #: 43

Topic #: 3

[All CPA-Financial Questions]

Topic #: 3

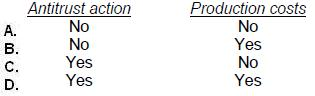

In 1990, Teller Co. incurred losses arising from its guilty plea in its first antitrust action, and from a substantial increase in production costs caused when a major supplier's workers went on strike. Which of these losses should be reported as an extraordinary item?

Suggested Answer:

C

Choice 'c' is correct. Yes - No.

Rule: Losses arising from a company's first (and probably 'last') 'anti-trust' action are unusual and extraordinary and should be reported as an extraordinary item. Losses resulting from additional costs caused by a strike at a major supplier or even at one's own company are not extraordinary and should be disclosed as a separate component of 'income from continuing operations.'

Currently there are no comments in this discussion, be the first to comment!