AICPA Exam CPA-Financial Topic 3 Question 31 Discussion

Topic #: 3

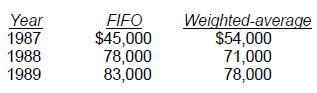

Goddard has used the FIFO method of inventory valuation since it began operations in 1987. Goddard decided to change to the weighted-average method for determining inventory costs at the beginning of 1990. The following schedule shows year-end inventory balances under the FIFO and weighted-average methods:

What amount, before income taxes, should be reported in the 1990 retained earnings statement as the cumulative effect of the change in accounting principle?

Choice 'a' is correct. $5,000 decrease.

The cumulative effect of change in accounting principle is determined as of the beginning of the year of change if comparative financial statements are not presented. In this case, the year of change is 1990, so the cumulative effect is the difference in inventory as of the end of 1989. [Note that inventory is a balance sheet item, so the change is based on the balances at the end of the last year the prior method was used. Had this question shown annual income statement amounts of cost of goods sold, we would have had to look at all the past years in the aggregate.] This will allow us to arrive at the adjustment to obtain the amount of retained earnings that would have been reported at the beginning of the period of change if the new accounting principle had been used for all prior periods.

Currently there are no comments in this discussion, be the first to comment!