AICPA Exam CPA-Financial Topic 3 Question 30 Discussion

Topic #: 3

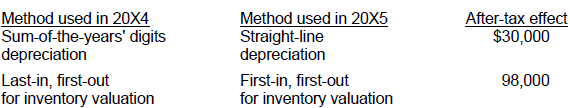

During 20X5, Dale Corp. made the following accounting changes:

What amount should be shown in the 20X5 retained earnings statement as an adjustment to the beginning balance?

Choice 'c' is correct. $98,000.

The cumulative effect of a change in accounting principle is now shown on the retained earnings statement as an adjustment to the beginning balance of retained earnings, assuming that the cumulative effect can be calculated. A change from LIFO to FIFO for inventory valuation (costing) is a change in accounting principle.

An exception is made however, for a change in depreciation method, since a change in depreciation method is no longer considered to be a change in accounting principle. A change in depreciation method is now considered to be both a change in principle and a change in estimate. These changes should now be accounted for as a change in estimate and handled prospectively. The new depreciation method should be used as of the beginning of the year of change and should start with the current book value of the underlying asset. No retroactive or retrospective calculations should be made, and no adjustment should be made to retained earnings.

Choices 'a', 'b', and 'd' are incorrect, per the above Explanation: .

Currently there are no comments in this discussion, be the first to comment!