AICPA Exam CPA-Financial Topic 3 Question 25 Discussion

Topic #: 3

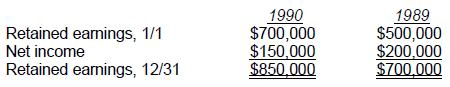

While preparing its 1991 financial statements, Dek Corp. discovered computational errors in its 1990 and 1989 depreciation expense. These errors resulted in overstatement of each year's income by $25,000, net of income taxes. The following amounts were reported in the previously issued financial statements:

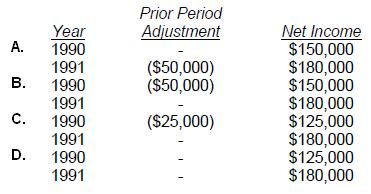

Dek's 1991 net income is correctly reported at $180,000. Which of the following amounts should be reported as prior period adjustments and net income in Dek's 1991 and 1990 comparative financial statements?

Choice 'c' is correct. 1990 ($25,000) $125,000

1991 -- 180,000

Because these are comparative financial statements, prior period adjustments require retroactive treatment for the years presented. Because 1989 is not presented, the 1989 correction is shown as a prior period adjustment of $25,000 to retained earnings statement of 1990.

Currently there are no comments in this discussion, be the first to comment!