Deal of The Day! Hurry Up, Grab the Special Discount - Save 25% - Ends In 00:00:00 Coupon code: SAVE25

AICPA Exam CPA-Financial Topic 2 Question 40 Discussion

Actual exam question for

AICPA's

CPA-Financial exam

Question #: 40

Topic #: 2

[All CPA-Financial Questions]

Topic #: 2

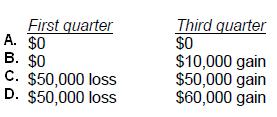

Wilson Corp. experienced a $50,000 decline in the market value of its inventory in the first quarter of its fiscal year. Wilson had expected this decline to reverse in the third quarter, and in fact, the third quarter recovery exceeded the previous decline by $10,000. Wilson's inventory did not experience any other declines in market value during the fiscal year. What amounts of loss and/or gain should Wilson report in its interim financial statements for the first and third quarters?

Suggested Answer:

A

Choice 'a' is correct. Temporary market declines in inventory need not be recognized at interim when a turn-around can reasonably be expected to occur before the end of the fiscal year.

Currently there are no comments in this discussion, be the first to comment!