AICPA Exam CPA-Financial Topic 2 Question 32 Discussion

Topic #: 2

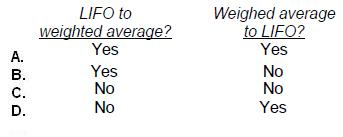

Is the cumulative effect of an inventory pricing change on prior years earnings reported on the financial statements for

Choice 'b' is correct. The cumulative effect of a change in accounting principle is now reported as an adjustment to beginning retained earnings when it is considered practicable to calculate the cumulative effect. When making a change to LIFO, it is generally considered impracticable to calculate the cumulative effect of the change (in most cases, data on the historical LIFO layers in not available). In a change to LIFO, the beginning inventory dollar amount becomes the first LIFO layer. No cumulative effect adjustment is made. The change is accounted for prospectively.

A change from LIFO to weighted average, there is no such impracticability. The cumulative effect is computed and the change is handled retrospectively.

Choices 'a', 'c', and 'd' are incorrect, per the above Explanation: .

Currently there are no comments in this discussion, be the first to comment!