Deal of The Day! Hurry Up, Grab the Special Discount - Save 25% - Ends In 00:00:00 Coupon code: SAVE25

AICPA Exam CPA-Financial Topic 2 Question 18 Discussion

Actual exam question for

AICPA's

CPA-Financial exam

Question #: 18

Topic #: 2

[All CPA-Financial Questions]

Topic #: 2

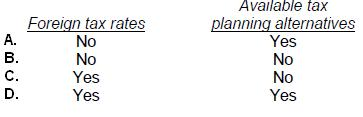

For interim financial reporting, the computation of a company's second quarter provision for income taxes uses an effective tax rate expected to be applicable for the full fiscal year. The effective tax rate should reflect anticipated:

Suggested Answer:

D

Choice 'd' is correct. Yes - Yes.

The effective income tax rates for operations for the full year should reflect anticipated foreign tax rates and available tax planning alternatives. In addition, the effect of other anticipated tax credits, capital gains rates, and foreign tax credits should be included.

Currently there are no comments in this discussion, be the first to comment!