AICPA Exam CPA-Financial Topic 1 Question 19 Discussion

Topic #: 1

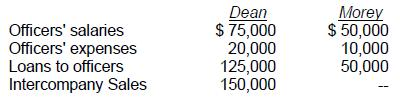

Dean Co. acquired 100% of Morey Corp. prior to 1989. During 1989, the individual companies included in their financial statements the following:

What amount should be reported as related party disclosures in the notes to Dean's 1989 consolidated financial statements?

Choice 'c' is correct. The only related party transaction that would require disclosure (assuming that all amounts are material to the financial statements) would be the loans to officers since they are outside of the ordinary course of business.

Choices 'a', 'b', and 'd' are incorrect. Officers' salaries, officers' expenses and intercompany sales (between entities included in a consolidated set of financial statements) are all transactions in the ordinary course of business and generally would not require disclosure.

Currently there are no comments in this discussion, be the first to comment!