AICPA Exam CPA-Business Topic 3 Question 37 Discussion

Topic #: 3

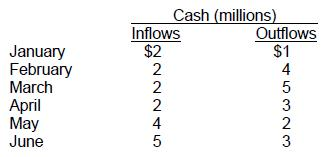

The treasury analyst for Garth Manufacturing has estimated the cash flows for the first half of next year (ignoring any short-term borrowings) as follows:

Garth has a line of credit of up to $4 million on which it pays interest monthly at a rate of 1 percent of the amount utilized. Garth is expected to have a cash balance of $2 million on January 1 and no amount utilized on its line of credit. Assuming all cash flows occur at the end of the month, approximately how much will Garth pay in interest during the first half of the year?

Choice 'a' is correct. First, determine the amount and timing of cash needs:

Comments

1 Given

2 Computed balance, positive cash flows

3 Computed balance, negative cash flows

4 Borrow from LOC

5 Computed balance, negative cash flows + interest

6 Cumulative LOC Balance

7 Computed positive cash flows

8 Computed balance, positive cash flows - interest

9 Immediate pay down of LOC

Choices 'b', 'c', and 'd' are incorrect, per the above calculation.

Currently there are no comments in this discussion, be the first to comment!