AICPA CPA-Business Exam - Topic 3 Question 17 Discussion

Topic #: 3

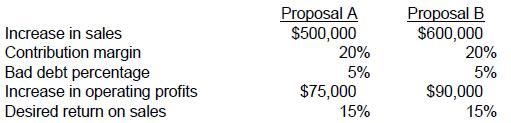

The sales manager at Ryan Company feels confident that if the credit policy at Ryan's was changed, sales would increase and, consequently, the company would utilize excess capacity. The two credit proposals being considered are as follows:

Currently, payment terms are net 30. The proposal payment terms for Proposal A and Proposal B are net 45 and net 90, respectively. An analysis to compare these two proposals for the change in credit policy would include all of the following factors, except the:

Choice 'b' is correct. Because the bad debt percentage is the same under either of the two proposals, there is no differential cost associated with bad debt. Because it is not a differential cost, it is not considered in comparing the two alternatives.

Choice 'a' is incorrect. Because Proposal A and B have different net collection dates, Proposal B will cause a greater amount of accounts receivable with a corresponding increase in working capital. The cost to fund this will be greater for Proposal B, so this is a legitimate concern.

Choice 'c' is incorrect. Customers may feel they should be given the extended terms. If this is granted, the additional working capital need will be even greater.

Choice 'd' is incorrect. Banks may require that days sales outstanding cannot exceed a certain number of days. If so, it will be harder to meet this covenant with Proposal B.

Darnell

4 months agoJosefa

4 months agoBambi

4 months agoCarma

4 months agoZachary

5 months agoDenise

5 months agoRegenia

5 months agoRenea

5 months agoFlorinda

5 months ago