AICPA Exam CPA-Business Topic 2 Question 21 Discussion

Topic #: 2

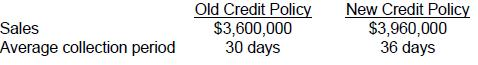

The following information regarding a change in credit policy was assembled by the Wilson Wax Company. The company has a required rate of return of 10 percent and a variable cost ratio of 60 percent.

The pretax cost of carrying the additional investment in receivables, using a 360-day year, would be:

Choice 'a' is correct.

Step 1 Determine the average accounts receivable balance and the additional accounts receivable as follows:

Therefore, the accounts receivable balance is $96,000 higher under the new credit policy.

Step 2 Determine the additional INVESTMENT in the additional accounts receivable.

Although Wilson has an additional $96,000 in accounts receievable, Wilson's actual investment in the additional accounts receivable is only 60% of $96,000 (because variable costs are 60% of sales). Wilson's investment in the additional accounts receivable is calculated as follows:

$96,000 x 60% = $57,600

Step 3 Calculate the cost of carrying the additional accounts receivable.

Wilson's additional investment in accounts receivable is $57,600 and we are given a 10% required rate of return. This means that Wilson's carrying cost of $5,760 is calculated as follows:

$57,600 x 10% = $5,760

Choices 'b', 'c', and 'd' are incorrect, per the above calculation.

Currently there are no comments in this discussion, be the first to comment!