Deal of The Day! Hurry Up, Grab the Special Discount - Save 25% - Ends In 00:00:00 Coupon code: SAVE25

Free AICPA CPA-Financial Exam Dumps

Here you can find all the free questions related with AICPA CPA Financial Accounting and Reporting (CPA-Financial) exam. You can also find on this page links to recently updated premium files with which you can practice for actual AICPA CPA Financial Accounting and Reporting Exam. These premium versions are provided as CPA-Financial exam practice tests, both as desktop software and browser based application, you can use whatever suits your style. Feel free to try the CPA Financial Accounting and Reporting Exam premium files for free, Good luck with your AICPA CPA Financial Accounting and Reporting Exam.Question No: 1

MultipleChoice

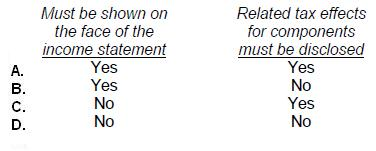

Which of the following is true regarding the presentation of "comprehensive income."