New Year Sale 2026! Hurry Up, Grab the Special Discount - Save 25% - Ends In 00:00:00 Coupon code: SAVE25

AAFM GLO_CWM_LVL_1 Exam - Topic 6 Question 11 Discussion

Actual exam question for

AAFM's

GLO_CWM_LVL_1 exam

Question #: 11

Topic #: 6

[All GLO_CWM_LVL_1 Questions]

Topic #: 6

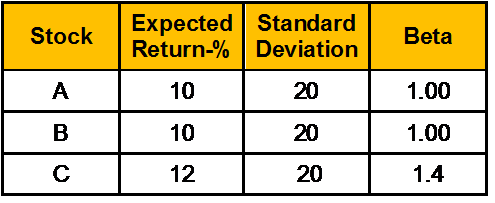

Consider the following information for three stocks, Stock A, Stock B, and Stock C. The returns on each of the three stocks are positively correlated, but they are not perfectly correlated.

Portfolio X has half of its funds invested in Stock A and half invested in Stock B. Portfolio Y has invested its funds equally in each of the three stocks. The risk-free rate is 5%, and the market is in equilibrium.

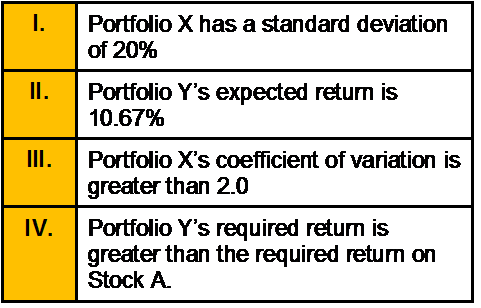

Which of the following statements is/are correct?

Suggested Answer:

B

Margarett

4 months agoPortia

4 months agoLachelle

4 months agoGwenn

5 months agoDaisy

5 months agoYoulanda

5 months agoKaitlyn

5 months agoLorean

5 months ago