Deal of The Day! Hurry Up, Grab the Special Discount - Save 25% - Ends In 00:00:00 Coupon code: SAVE25

AAFM Exam GLO_CWM_LVL_1 Topic 5 Question 50 Discussion

Actual exam question for

AAFM's

GLO_CWM_LVL_1 exam

Question #: 50

Topic #: 5

[All GLO_CWM_LVL_1 Questions]

Topic #: 5

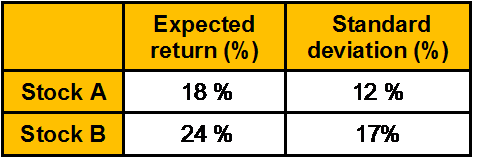

Consider two stocks, A and B

The returns on the stocks are perfectly negatively correlated.

What is the expected return of a portfolio comprising of stocks A and B when the portfolio is constructed to drive the standard deviation of portfolio return to zero?

Suggested Answer:

B

Currently there are no comments in this discussion, be the first to comment!